With the world shifting to communicate, work and transact online at an ever-increasing rate, online security is one of the most important areas of investment for many companies. The rise of eCommerce in recent years, and even more so in 2020, has made the need for top-level security paramount for when processing payments, with one source stating that Card-not-present fraud is now 81% more likely than card-present fraud

Enter 3DS

The latest form of additional security is powered by Visa, MasterCard, and American Express in order to authenticate customers and move the risk of fraudulent transactions from the merchant to the card issuer.

What is 3DS?

Put simply, 3DS is an extra layer of security for merchants and customers for online credit and debit card transactions and is used to authenticate the customer at the time of payment

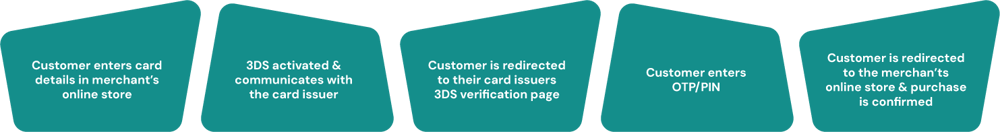

It assesses the risk associated with the transaction and may require additional authentication by redirecting the customer to the card issuers website to complete an extra security step (such as entering a one-time password – OTP)

Its use in Singapore is already mandatory, however, while available in Australia, it is not required and is the choice of the merchant as to whether it is implemented.

How does it work?

There are two types of 3DS flows; frictionless, and OTP. The option the bank chooses will depend on your requirements and past transaction history.

One-Time-Password (OTP)

Frictionless

In this process, the card issuer determines the risk associated with the transaction, and therefore whether the transaction should be further authenticated or not. If the issuer requires authentication, the flow is as shown above. If not, the flow is as seen below.

What are the benefits?

Implementing 3DS is generally fast and easy, with minimal additional cost to merchants. It provides you and your customers protection against potentially fraudulent card transactions and lowers the risk of disputed transactions

One of the other key benefits is that the fraud liability is moved from the merchant to the card issuer, so disputes and chargebacks lie with them.

Benefits for you (the merchant):

- Risk moves from you to the card issuer

- Less likelihood of chargebacks

- Lower risk of fraudulent orders

- Low cost of activation

Benefits for your customers

- Enhances card security – with a less chance of fraudulent transactions

- Increases customer confidence for processing a payment on your website

- Easy to use & mobile friendly

- Low additional cost that is included in any surcharge that is passed on

What is 3DS 2.0?

3DS1 was originally created more than 15 years ago, and 3DS 2.0 was recently released (2018 with 2019-2020 global rollout) and saw the system streamlined and enhanced in order to address many of the key pain points seen in 3DS1. This included streamlining how the process worked and ensuring its seamless implementation on mobile devices. As a result of this and the elimination of an initial enrollment process, customer experience when using 3DS2 has been significantly improved compared to 3DS1

Confused about some of the terms associated with 3DS? Check out this 3DS glossary.

Should you consider 3DS for your business?

There are clear benefits to enabling 3DS for your online payments, and if you’re a Mint customer, it’s fast and easy to activate now, but it’s important to consider your set up and transaction history. If you have experienced several fraudulent transactions (and associated chargebacks), or see a high volume of disputes, then 3DS2 is a great way to further protect yourself

If you would like to learn more about 3DS2, how it could be beneficial for your business, and how much it costs, then reach out to our sales team today.

/Logos/RGB%20Mint%20Logo%20Forrest.png?width=431&height=188&name=RGB%20Mint%20Logo%20Forrest.png)