When it comes to pricing for payments, things can get a little bit confusing. Factors like the type of payment product, type of payments you’re processing, and the industry you work in, can all impact the pricing that you are able to access. We’re taking a look at how you can navigate the pricing that you come across and how to understand the true cost to your business.

Card Processing

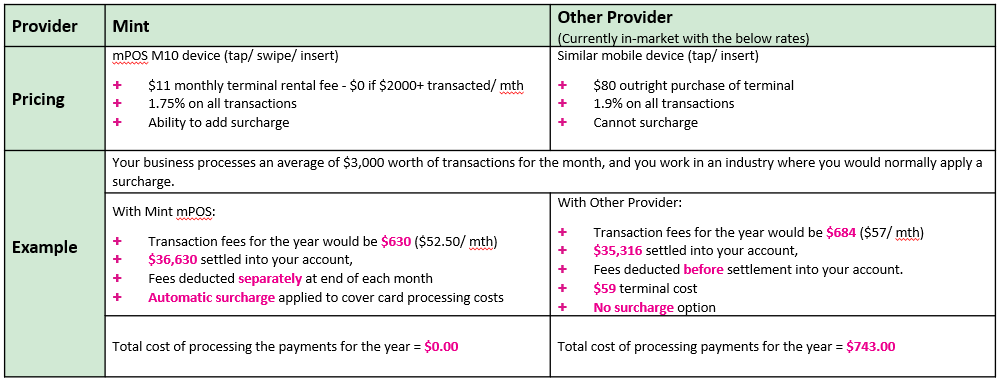

When it comes to card processing, there are two key factors you should consider as a starting point – merchant service fees, and terminal fees – keeping in mind that these are often not the only costs associated with card processing.

Merchant Service Fees

This is where the focus often lies, and the area where much of the confusion can arise. The merchant service fee (also known as MSF) is what your business is charged to process a transaction.

There are three types of MSFs that are commonly seen:

Blended Rates

This is one rate that covers all (or a group of) card schemes. For example, you may have a rate of 1.8% that covers all Visa and Mastercard card types.

This pricing model is often suited to small to medium sized businesses.

Differential Rates

This is a defined rate for each card scheme – Visa, Mastercard, American Express, EFTPOS etc. – this breakdown can be beneficial for medium to large businesses who have visibility over the breakdown of card schemes that their customers are using.

Interchange ++

These rates are often broken down by both card scheme and card type to provide extremely granular pricing – it is made up of the scheme, issuing bank, and provider fees. For example, you would have a different rate for each of the various levels of Visa, Mastercard, American Express, and international cards.

This type of pricing is often best suited to large and enterprise-sized businesses that process a large volume of transactions.

Terminal Fees

There are options to either rent or buy a terminal depending on the company and type of terminal you are looking at getting for your business. There are generally two options here: rent or buy. With some providers, you may not have the choice.

Buy – buying a payment terminal outright means that you wholly own the machine and would not incur any associated fees for returning the machine at the end of your contract or for any damage to the machine. In the same way, this does mean that the cost of fixing any issues beyond what is included under the terminal’s warranty would sit with you, and not your provider – this would include purchasing a new terminal if it no longer works.

Rent – renting a payment terminal means you pay a fee regularly (e.g. monthly), and do not own the machine regardless of how long you have it. At the end of your contract you would need to return the device, and failure to do so could attract additional fees. If the device has an issue (other than one caused by your team such as dropping the device), then your provider will likely, organize for the device to be replaced, depending on contract.

When deciding on a payment terminal, there are a range of factors that need to be considered, and it’s important to remember that a physical payment terminal may not be the best option both from a functionality and cost perspective.

When looking for a terminal, ask yourself:

- What type of cards do my customers primarily use?

Visa, Mastercard, American Express? Are they using credit cards, debit cards, or EFTPOS cards? - Do I have to have a physical terminal or would a virtual terminal be adequate?

If you are taking payments over the phone regularly, or your customers are happy to provide the card details to you, then a virtual terminal may be suitable. - Do you want to ability to send your customers a link that they can use to pay through?

A virtual terminal and associated Hosted Payments Page would give you the ability to share a link with your customers on an invoice or email so that they can pay directly, and maintain the security of their card details.

Need help with surcharging? Find out how to calculate your cost of acceptance here.

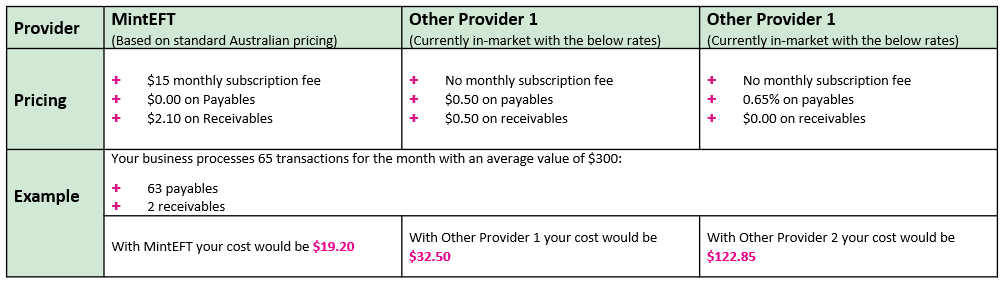

EFT (B2B) Payments

There are a few different ways that EFT payments can be charged, and the overall cost to your business can vary significantly. It is also important to note, that fees can vary based on the type of business you are, and the volume of payments your business puts through.

The three components of EFT pricing models that you need to consider are:

- Monthly fees

- Fees for sending each payment (payables)

- Fees for receiving each payment (receivables)

Which of these apply and how much they are will depend on the provider. Let’s look at an example:

Based on this example, using MintEFT would save you $13.30 for the month compared to other provider 1, and $103.65 compared to other provider 2.

Other costs to keep in mind

Some other fees that can be associated with processing card payments may include:

- Set up or establishment fees

- Plan fees such as a flat monthly subscription or admin fees

- Additional fees for optional security features (e.g. 3DS)

- This can reduce costs overall for your business by reducing the rate of chargebacks and supporting you in fighting them.

- Chargeback or dispute fees for card processing

- This is the fee charged to you when a cardholder disagrees with a charge on their card, and disputes it with their bank. In this scenario, you would need to provide evidence that the charge was legitimate, so things like 3DS can assist greatly here.

- Account cancellation fees – this can include general fees associated with closing your account (this may depend on your provider and whether you have committed to a minimum contract period), and fees associated with returning a payment terminal if you have rented one.

It is important to understand these fees and factor them into your decision-making process, but also ask your provider whether there are discounts or introductory offers available to you, or if they can provide discounts because you process a high volume of payments or transactions.

At Mint we believe in providing customers with great value, so we always like to find out more about your business, payment needs, and what your current payment set-up looks like. With our range of solutions, it is possible to tailor a set of products to suit your needs and get efficiencies across the board when it comes to cost, time, and better customer experience.

Reach out to us today to find out more about our products and discuss the needs of your business!