Paying by card has become the preferred way to pay for goods and services, resulting in higher fees for business owners. It may only be $0.10c or $0.15c per transaction – but thousands of these transactions over a 1-month period results in fees that the merchant must pay. The decision to pass on the payment surcharges to your customers is one that every business owner is debating. To help you along, we've put together this guide to the most common questions we get asked about surcharging and the rules around what you can include in your customer surcharge model.

What is a card surcharge?

A card surcharge is an additional fee merchants charge a customer when they pay using a credit, debit or EFTPOS card in order to cover or offset the cost associated with accepting card payments.

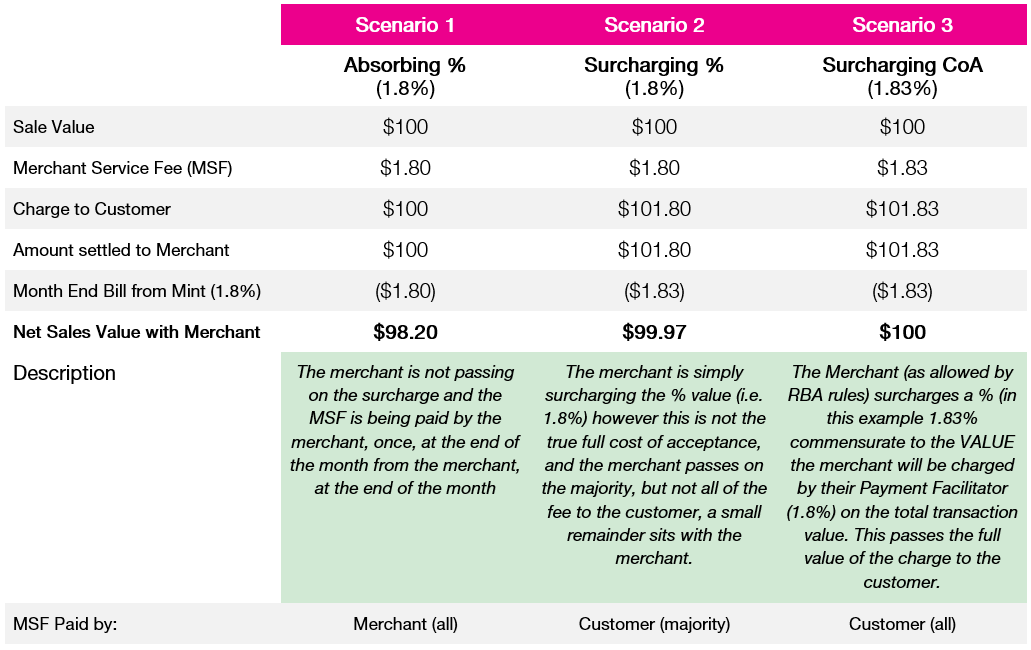

There are three options retailers (including newsagents) need to consider when surcharging customers:

- Absorb the Cost

Absorb all costs associated with processing card payments by factoring this into your price. - Pass on your Merchant Service Fee (MSF)

Charge customers the same rate that you’re charged. - Calculate your Full Cost of Acceptance

Charge customers a rate that covers all costs associated with accepting card payments.

Do I have to apply a surcharge for customers?

This is entirely up to you. Some businesses choose to pass on this cost to customers, while others choose to absorb this cost. Given the explosion of card payments in recent times, owners have seen their fees increase significantly. With low margins and cash tied up in stock on shelves, more and more retail businesses, including newsagents, are deciding to implement the surcharge model.

What are the rules about surcharging?

The most recent update to the rules around surcharging is set out in the Competition and Consumer Amendment (Payment Surcharges) Act 2016. The Act states that merchants must not charge a payment surcharge that is “excessive”.

But what does this mean exactly? A surcharge will be excessive if it exceeds the permitted surcharge referred to in the Reserve Bank of Australia standards or regulations, i.e. it should be limited to the amount it costs you to accept that type of card transaction and cannot exceed your average annual cost of acceptance. Don't worry though, we've put together a short list of what you can factor into a surcharge and have included some examples below on how it can work.

Are there other costs that can be factored into my surcharge?

There are a number of costs related to the acceptance of card payments that can be factored into your cost of acceptance (CoA). It is important to remember that these costs need to be directly related to your business being able to accept card payments.

- Fees for the rental and maintenance of payment card terminals

- Fixed fees paid to your payments provider (e.g. monthly or annual fees)

- Line rental and communications charges directly related to the use of payment card terminals

- Fixed equipment, systems or development costs that are directly associated with how you accept payments – these costs need to be apportioned over a period of five years from the date the cost was incurred

- Fraud costs related to card acceptance including fraud mitigation procedures (i.e. two factor authentication, also known as 3DS)

- Transaction value of any fraud-related chargebacks or chargeback fees – provided you have adopted generally available fraud mitigation procedures

If you choose to surcharge different rates for each card type, you will need to apportion any monthly fees or fixed costs based on the amount that each card type is used for your business. i.e. if 35% of your transactions are Visa, then 35% of your monthly terminal rental fee would be factored into your cost of acceptance for Visa cards. Note that Mint offers newsagents ‘blended’ rates, which is the same rate for both Visa and Mastercard. This makes calculating the CoA much easier – in fact, the cost of acceptance is calculated by Mint Payments and is listed on your monthly statements.

There are a few things that you cannot include when calculating your cost of acceptance, these include but are not limited to any fines received for non-compliance with rules or standards, and general business costs including staff & staff training, electricity, rent etc.

How do I calculate my cost of acceptance?

We will be looking at the three main ways to surcharge; absorbing the cost (scenario 1), charging only your MSF (scenario 2), and calculating and charging your full cost of acceptance (scenario 3).

EXAMPLE – Mike’s T-Shirts

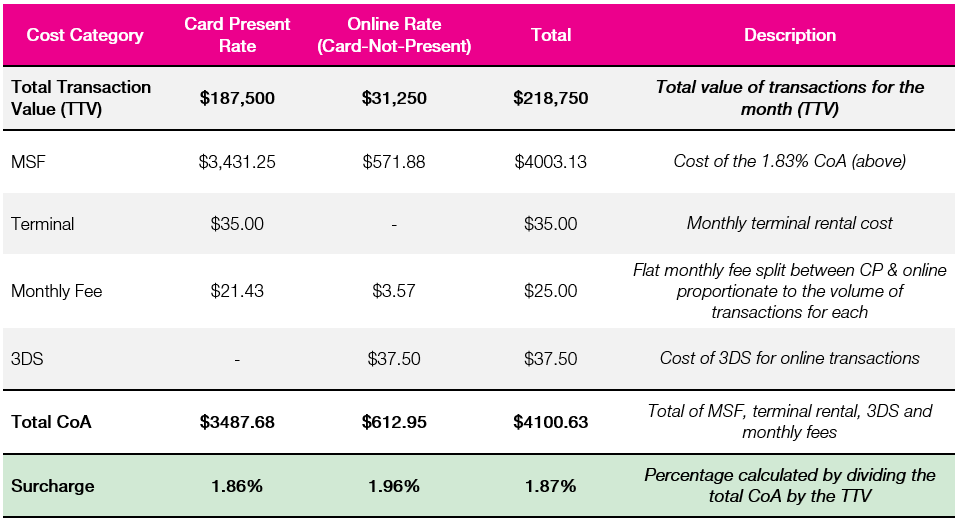

What would this look like building on the example above? Let’s assume our Merchant (Mike) wants to surcharge his total cost of acceptance, what would be an appropriate surcharge % if we include his other allowable costs…

Mike’s T-Shirts typically completes 750 transactions per month in his bricks & mortar via one terminal from Mint costing $35. He is on an MSF of 1.8% of total transaction value with no transaction fee. Mike also completes a further 125 transactions through his online platform and is using Mint’s 3DSecure technology (at 30c per transaction) helping protect against fraudulent payments. He also has a flat monthly fee of $25. Across both his physical and online stores, the average sale price is $250. What can Mike reasonably surcharge his customers?

In this example, Mike can surcharge 1.86% for card present and 1.96% for online transactions. If Mike would prefer to charge one rate across both online and in-person transactions, he can charge 1.87%

What options do I have for surcharging with Mint?

Mint’s platform and all our solutions provide full flexibility and enable merchants to easily select options for a full or partial surcharge or no surcharge at all

If you choose to add a surcharge for your customers, you can choose the rate that will be charged, but note that to comply with Australian laws, this should be limited to the permitted cost of acceptance as outlined by the RBA.

If your cost of acceptance differs between card types (e.g. VISA vs MasterCard vs Amex), you have the option to apply different surcharge rates to each card type for online payments or with your Move5000 commensurate with the relevant transaction costs for that card type.* Alternatively, if you have a blended rate, then you can apply one rate across all card types – but do bear in mind that it is the merchant’s responsibility to ensure this is in line with what the RBA deems permissible. This should be reviewed every 12 months to ensure accuracy.

For further information:

RBA – Guidance Note: Interpretation of the Surcharging Standards

ACCC – Q&A on Payment Surcharges